Climate Change and Energy

- Home

- Environmental Stewardship

- Climate Change and Energy

As members of the Prologis Group, NPR and Prologis REIT Management K.K. (PLDRM) recognize that global climate change is a scientific fact. We believe that taking legitimate actions to respond to climate change, which would mitigate various potential risks of our portfolio to be caused by climate change, is one of our material management issues.

Per this understanding, the Prologis Group, NPR and PLDRM have categorized the “response to climate change” as one of our material issues that would certainly significantly impact our future business environment.

Prologis’ Carbon Management Approach

Prologis’ Carbon Management Approach hits the sweet spot between creating business value and reducing our carbon impact. It also furthers our efforts toward achieving our science-based target (SBT) for reducing greenhouse gas (GHG) emissions. Prologis' carbon emissions footprint covers emissions from our direct operations (Scope 1 and 2) and all other indirect emissions stemming from our global portfolio/construction activities/other aspects of our business (Scope 3). We focus on emissions reduction across our whole business, both direct and indirect, which includes decreasing emissions from energy use in our offices and customer spaces. Subsequently, Prologis purchases carbon offsets and renewable energy credits (RECs) to neutralize the remaining operational emissions (Scope 1 and 2).

In 2022, Prologis group committed to achieve net zero emissions across its entire value chain by 2040.

The goal represents a significant opportunity for Prologis to serve its customers in new and innovative ways on sustainability initiatives. It includes several interim targets:

- 1 GW of solar generation capacity (supported by storage) by 2025

- Carbon neutral construction by 2025

- Net zero for operations by 2030

Prologis’ carbon reduction efforts are driven by our customer-centric initiatives. For example, through Prologis Essentials LED, we unlock energy cost savings for our customers, while reducing our indirect emissions (Scope 3). Through other collaborations, such as Prologis’ Customer Sustainability Advisory Council (CSAC), we are identifying solutions that help Prologis and our customers reduce our collective carbon impacts. The CSAC forum goes beyond the norm to strengthen customer relationships, while also providing insight into their evolving needs on topics like renewable energy and electric vehicles, among others.

Initiatives for Energy Efficiency

In cooperation with building management companies, property managers of Prologis Japan periodically analyze monthly energy consumption by usage in our customer’s leased area and provide energy saving advice to our customers, which include reducing or dimming lighting fixtures, switching to intermittent operation of ventilation fans, and turning on heat recovery features of ventilators. We also recommend using window blinds and setting the temperature of air conditioners at 28 degrees Celsius for summer and 20 degrees Celsius for winter.

Provision of Energy Solutions

Renewable Energy

Beyond identifying ways to consume less energy, Prologis is contributing to a low-carbon future by managing our properties as a platform to generate or utilize large volumes of clean electricity. Over the past decade, Prologis has emerged as a leader in corporate solar deployment. Prologis group’s long history of investments in energy-related lines of business includes on-site solar and EV charging. The group currently has approximately 544 MW of rooftop solar globally as of December 2024.

Our emphasis on renewable energy puts us in alignment with the United Nations Sustainable Development Goal 7 (affordable and clean energy), and we set an ambitious new goal of 1GW of installed capacity by 2025. As our customers pursue their own environmental goals and carbon-reduction targets, deploying Prologis installed solar energy at our warehouses is an example of shared value creation made possible by our experience, scale and core business strength.

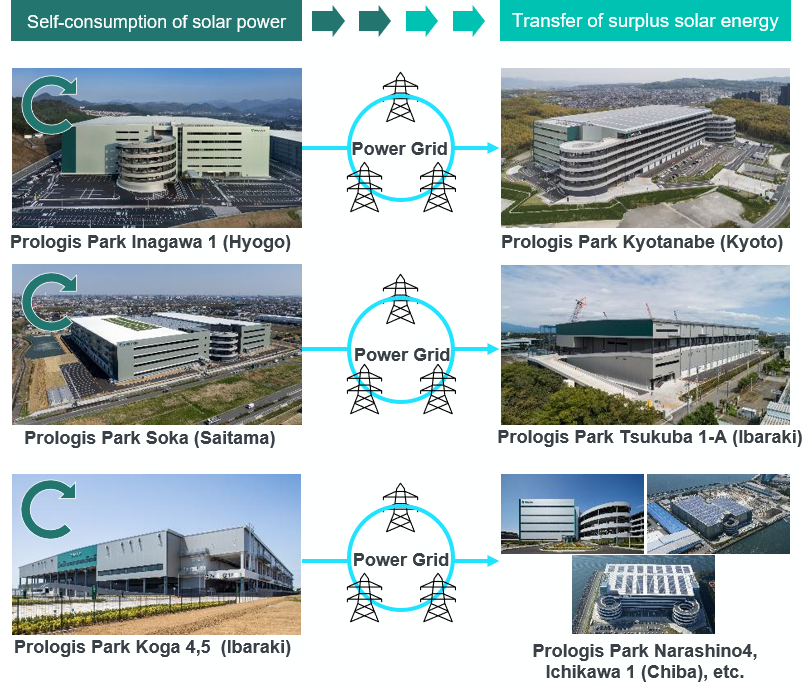

Self-consumption of renewable energy and self-wheeling of surplus power

Electricity generated by our solar PV systems is consumed on site, while any surplus power is supplied to other facilities via self-wheeling (self-consignment) to optimize overall energy use. In January 2024, we began supplying electricity from Prologis Park Inagawa 1 to Prologis Park Kyotanabe. In August 2024, supply was expanded from Prologis Park Soka in Soka City, Saitama Prefecture to Prologis Park Tsukuba 1-A in Tsukuba City, Ibaraki Prefecture.

Furthermore, since March 2025, we have also been supplying electricity from the Prologis-developed properties Prologis Park Koga 4 and 5 to multiple properties owned by NPR, including Prologis Park Narashino 4, Prologis Park Ichikawa 1, Prologis Park Zama 2, and Prologis Park Tsukuba 1-A, 1-B and 2.

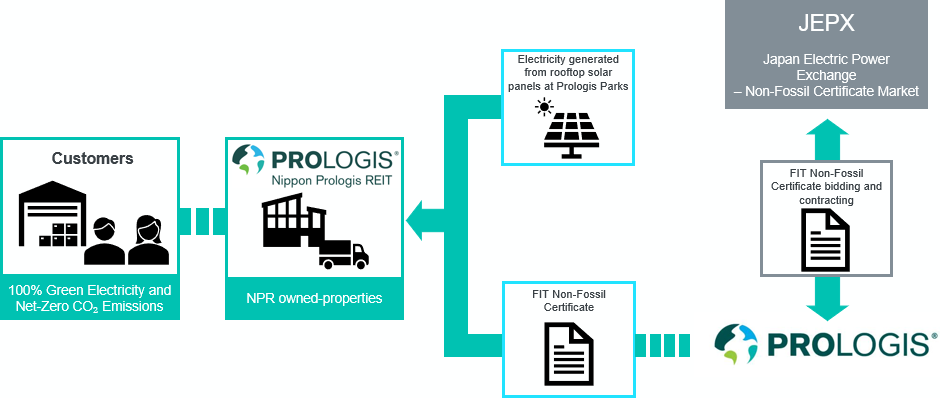

100% Green Electricity and Net-Zero CO2 Emissions through Non-Fossil Certificates

In addition to using electricity generated by solar PV systems, we apply FIT Non-Fossil Certificates with tracking, enabling all electricity used within our facilities to achieve net-zero CO2 emissions.

TCFD Disclosure

Support for TCFD Recommendations

The Prologis Group has officially expressed its support for the Recommendations made by the Task Force on Climate-related Financial Disclosures (TCFD), which was established by the Financial Stability Board (FSB) to consider how to disclose climate-related information. PLDRM, as the asset manager for NPR, has also officially expressed its support for the Recommendations by TCFD in September 2021.

The TCFD final report recommends that corporates/organizations elaborate the following information in connection with their businesses in their disclosure documents:

| Core Elements | Information to be Disclosed |

|---|---|

| Governance | Organizational governance relating to climate-related risks and opportunities |

| Strategy | Actual and potential impacts from climate-related risks and opportunities on the organization's businesses, strategies, and financial planning |

| Risk Management | The organization's climate-related risk identification, assessment, and management processes |

| Metrics and Targets | Metrics and targets used to assess and manage climate-related risks and opportunities |

PLDRM also joined the TCFD Consortium, an organization established to discuss effective disclosure and initiatives that would allow investors to make appropriate judgment of various corporate activities in the area of sustainability. The TCFD Consortium is consisted of corporates/organizations who are the official supporters of TCFD in Japan.

Governance

Please refer to the ”ESG POLICY AND MANAGEMENT SYSTEM” page for the governance structure of PLDRM that promotes ESG initiatives (including responses to climate change; the same hereafter) of NPR.

Strategy

Scenario Analysis

PLDRM conducts scenario analysis to identify the risks and opportunities for NPR to be posed by the climate change, and to assess their potential impact on NPR’s business.

| Scenarios | Overview of Scenarios | References |

|---|---|---|

| 1.5℃ Scenario | Global GHG emissions shall be reduced by the implementation of strict regulations and taxation systems to realize a decarbonizing society. In this scenario, physical risks tend to be low and transition risks tend to be high. |

IEA(1) NZE2050 IPCC(2) RCP2.6 |

| 4℃ Scenario | Global GHG emissions shall not be materially reduced due to the lack of progress in global decarbonization efforts. In this scenario, natural disasters will likely be severe, and therefore, physical risks will likely be extremely high, while transition risks will likely be relatively small due to the lack of progress in strengthening legal regulations. |

IEA SPS IPCC RCP8.5 |

- IEA: International Energy Agency

- IPCC: Intergovernmental Panel on Climate Change

Risks and Opportunities and Countermeasures

PLDRM has assessed the risks and opportunities which would have potential impacts on NPR’s business and portfolio. The assessment includes probabilities, possible financial impacts and potential countermeasures of the risks and opportunities as set forth in the following table:

| Risk and Opportunity Events | Probability | Financial Impacts Potential Countermeasures |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| 1.5℃ | 4℃ | Operating Revenue | Operating Expenses incl. CAPEX | Non-Operating Expenses incl. Capital Cost | Asset Value factored by NCF | Asset Value factored by Cap Rate | |||

| Transition Risks |

Policies and Laws |

Additional expenses incurred based on the amount of GHG emissions such as introducing carbon tax etc. | Middle | Low | - | Small | - | Small | - |

|

|||||||||

| Strengthening of energy-saving standards in real estate operation | Middle | Low | - | Middle | - | Middle | Middle | ||

|

|||||||||

| Technology | Deterioration in operating portfolio compared with competitors by rapid innovation regarding energy-saving efficiency | Middle | Middle | Middle | Middle | - | Middle | - | |

|

|||||||||

| Market / Reputation |

Customer's increasing demand for properties regarding energy efficiency and climate change adaption etc. | High | High | Middle | - | - | Middle | - | |

|

|||||||||

| Debt/equity investors and lenders' behavior changes in relation to climate change initiatives | High | Middle | - | - | Middle | - | - | ||

|

|||||||||

| Decrease in appetite for investments on properties adapted to climate change adaption inadequately | High | Low | - | - | - | - | Small | ||

|

|||||||||

| Physical Risks |

Acute Risks |

Damages in operating portfolio by increased/intensified typhoons, heavy rains, river floods etc. | Low | Middle | - | Middle | - | Middle | - |

|

|||||||||

| Chronic Risks |

Submergence of properties located in coastal area due to sea level rise | Low | Low | Large | Large | - | Large | Large | |

|

|||||||||

| Increase in costs of energy/insurance premium/raw material etc. in response to climate change and tremendous natural disasters | Middle | Middle | - | Middle | - | Middle | - | ||

|

|||||||||

Events which may bring in positive impacts (opportunities)

Risk Management

PLDRM intends to control and manage the ESG-related risks for NPR with the following procedures:

General Climate Change Risks

The risks and opportunities described in the preceding table are discussed by the ESG Committee of PLDRM. The risks and opportunities are monitored by applicable/responsible departments of PLDRM who are in charge of various sustainability initiatives. When countermeasures are needed, an applicable agenda is proposed and discussed at the ESG Committee.

Investment Decision Making

PLDRM makes decisions for NPR’s new investments through PLDRM’s Investment Committee. As a part of due diligence for the investment decision making process, PLDRM conducts assessment of the climate change risks. For example, PLDRM investigates the risks of potential floods associated with subject investments, utilizing various hazard maps prepared by municipalities. Also, PLDRM prioritizes acquisitions of properties with the environmental certifications and properties equipped with energy-saving systems, etc.

Metrics and Targets

PLDRM stipulates key metrics and targets, or major sustainability KPIs, in an attempt to monitor the progress of countermeasures being taken by the Prologis Group and NPR vis-à-vis the climate change problems.

Sustainability KPIs of the Prologis Group

In 2022, Prologis established a new SBT: We will achieve net-zero emissions across our value chain by 2040 from a 2019 baseline.

| Net-zero emissions | Target Years |

|---|---|

| Scope 1 & 2 | 2030 |

| Scope 3 | 2040 |

Sustainability KPIs of NPR

NPR is committed to achieving the following sustainability KPIs.

| Goals | Target Years |

|---|---|

| Acheving a 52% reduction in GHG emissions compared to 2023 levels | 2030 |

| Acheving a more than 90% reduction in GHG emissions compared to 2023 levels (Net-Zero) | 2040 |

| Installation of solar panels with 75MW power generation capacity | 2030 |

| Installation of LED lighting for 100% of total net rentable area (excluding cold storage facilities) | 2030 |

| Introduction of green lease contracts for 70% or more of total net rentable area | 2026 |

| Continuing Eligible Green Project ratio at 95% or more (acquisition price basis) | - |

ESG

ESG