Corporate Governance

- Home

- Ethics and Governance

- Corporate Governance

NPR’s Corporate Governance

Organization of NPR

In accordance with the “Act on Investment Trusts and Investment Corporations (ITA)” of Japan, NPR is incorporated as a Japanese real estate investment trust, or a J-REIT, and governed by unit holders’ meetings and a Board of Directors who represent the interests of our unit holders. Pursuant to the ITA, J-REITs are not permitted to have any employees and are required to outsource all asset management operations. NPR has entered into an asset management agreement with Prologis REIT Management K.K. (PLDRM), the Asset Manager, a joint stock company incorporated under Japanese law.

General Meeting of Unit Holders

General meetings of unit holders are held in accordance with the ITA and our articles of incorporation. For unit holders residing outside Japan, we send the notice of general meetings to their standing proxy or mailing address in Japan. Except as otherwise provided by law or by our articles of incorporation, unit holders may adopt a resolution at a general meeting of unit holders by a majority vote cast. At a general unit holder meeting, unit holders are entitled to exercise one voting right per investment unit. All of our issued and outstanding units have equal voting rights. We have not issued any investment units that are subject to restrictions on the exercise of voting rights.

General principles of our investment policies are stipulated by our articles of incorporation. Amendment of such general principles of investment policies requires a super-majority vote of our unit holders. Besides such general principles, the manner in which we implement our investment objectives may be enacted by the Board of Directors or delegated by the Board of Directors to the Asset Manager without an approval of our unit holders. Because of this broad discretion, strategies for implementing our investment objectives may be amended without an approval of our unit holders in a way that could potentially be inconsistent with the possible expectations of our unit holders.

Proposals Approved at General Meeting of Unit Holders

Our articles of incorporation stipulate that our general meetings of unit holders shall be convened on or after August 1st every two years without delay. The articles of incorporation direct us to ensure that a general unit holder meeting is held no later than 25 months after the previous general meeting that was held in accordance with the relevant provisions of our articles of incorporation. At the 7th general meeting of unit holders held on August 28, 2024, the following proposals were submitted and approved.

| Proposals Approved at the 7th General Meeting of Unit Holders | ||

|---|---|---|

| Proposal 1 | Partial Amendment of NPR’s Articles of Incorporation | The proposal was approved as originally proposed. |

| Proposal 2 | Election of One Executive Director | The proposal was approved as originally proposed and Mr. Satoshi Yamaguchi was re-elected as NPR’s Executive Director. |

| Proposal 3 | Election of One Substitute Executive Director | The proposal was approved as originally proposed and Mr. Kenji Saeki was elected as NPR’s Substitute Executive Director. |

| Proposal 4 | Re-election of Three Supervisory Directors | The proposal was approved as originally proposed and Mr. Yoichiro Hamaoka, Ms. Mami Tazaki and Mr. Kuninori Oku were re-elected as NPR’s Supervisory Directors. |

Executive, Supervisory Directors and Board of Directors

Our articles of incorporation require that we have one or more Executive Directors and two or more Supervisory Directors.

Our articles of incorporation also require that we have at least one more Supervisory Director than the number of Executive Directors.

The Board of Directors is currently comprised of one Executive Director and three Supervisory Directors. All Directors are elected and appointed at general meetings of our unit holders. The Executive Director represents NPR and has responsibility for the administration of NPR’s various activities. The Supervisory Directors are entirely independent of the Asset Manager and its shareholder, the Prologis Group. The Supervisory Directors have a statutory duty to review the Executive Director’s administration of NPR’s activities. Our Executive Director and Supervisory Directors work together to ensure that we comply with legal, tax and other regulatory requirements, including those arising under the ITA and related to J-REIT regulatory provisions. Certain responsibilities of the Executive Director set out in the ITA, such as convening general meetings of unit holders and entering into or terminating the asset management agreement, require a resolution of the Board of Directors. The quorum for a resolution is a majority of the members of the Board of Directors, and the adoption of a resolution requires a majority of the votes present at the board meetings. If any Director has a conflict of interest with respect to a proposed resolution, the Director is not counted for purposes of achieving a quorum, and he or she is disqualified from voting.

Currently, our Executive Director is Mr. Satoshi Yamaguchi and our Supervisory Directors are Mr. Yoichiro Hamaoka, Ms. Mami Tazaki and Mr. Kuninori Oku. Our articles of incorporation, which is set forth by resolutions at general meetings of our unit holders, defines that the maximum amount of remuneration for the Executive Director is ¥1,000,000 per month and the maximum amount of remuneration for the Supervisory Directors is ¥500,000 per month per person. The Board of Directors is responsible for determining an actual amount of compensation for the Executive Director and the Supervisory Directors in light of macroeconomic environment of Japan and general wage levels of Japanese labors.

All of compensation to be paid to the Directors is fixed remuneration and the amount is not linked with NPR's financial performances, including its profitability and investment unit price, etc.

Our Supervisory Directors have no specific business/economic interests with the Asset Manager and the Prologis Group, and therefore, they shall be able to supervise and review the administration of NPR independently.

The following table summarizes key information pertaining to the Directors:

Commitment to Board Diversity

In nomination of Directors of the Board, their diverse backgrounds, including gender, race/ethnicity, nationality, specialty, experience and skillsets, are considered.

Board of Directors (As of May 31, 2025)

| Title | Name | Reason for Election | Gender | Number of Units Owned | Attendance at Board of Directors’ Meetings (Since September 2020) |

Remuneration for Most Recent 6 Month Period (Thousand yen) |

Tenure |

|---|---|---|---|---|---|---|---|

| Executive Director |

Satoshi Yamaguchi |

Since Mr. Satoshi Yamaguchi has extensive knowledge of real estate transactions as a real estate appraiser and has long-term experiences of management of Nippon Prologis REIT, as the Chief Investment Officer of the Asset Manager, he was appointed as the Executive Director. | Male | 12 | 38 times out of 38 (100%) |

- | 2 years 9 months |

| Supervisory Director |

Yoichiro Hamaoka |

Since Mr. Yoichiro Hamaoka has extensive knowledge of the fairness and transparency of real estate transactions as a real estate broker and has experiences of management and governance of several companies, he was appointed as the Supervisory Director. | Male | 0 | 64 times out of 65 (98.5%) |

2,400 | 12 years 6 months |

| Supervisory Director |

Mami Tazaki |

Since Ms. Mami Tazaki has extensive knowledge of the financial industry and extensive skills and experiences in auditing corporate accounts and risk management, she was appointed as the Supervisory Director. | Female | 0 | 65 times out of 65 (100%) |

2,400 | 6 years 8 months |

| Supervisory Director |

Kuninori Oku |

Since Mr. Kuninori Oku is well versed in various laws and regulations including real estate transactions and corporate risk management as a lawyer, he was appointed as the Supervisory Director. | Male | 0 | 65 times out of 65 (100%) |

2,400 | 4 years 9 months |

| Title | Name | Knowledge, Skills and Experience | ||||||

|---|---|---|---|---|---|---|---|---|

| Executive Management | Real Estate Management | Real Estate Investment | Finance/ Accounting |

Audit/Risk Management |

Legal/ Compliance |

ESG | ||

| Executive Director |

Satoshi Yamaguchi | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Supervisory Director |

Yoichiro Hamaoka | ✓ | ✓ | ✓ | ✓ | |||

| Supervisory Director |

Mami Tazaki | ✓ | ✓ | |||||

| Supervisory Director |

Kuninori Oku | ✓ | ✓ | |||||

Please see the link below for the biographies of the directors.

VIEW BIOGRAPHIES OF NPR’S BOARD OF DIRECTORSEvaluation of the Effectiveness of NPR's Board of Directors

NPR evaluates the Board of Directors by conducting a survey to be answered by each director once a year to maintain and improve the effectiveness of the Board. The results of the survey are compiled by PLDRM and reported to the Board of Directors. The Board reviews the results in detail, and if it identifies any items which require improvement, the Board will formulate and implement improvement plans.

In the third survey conducted in January 2025, all items were evaluated satisfactory and no improvement items were identified. As a result, the effectiveness of NPR’s Board of Directors was fully confirmed.

Independent Auditors

Under the ITA, we must appoint independent auditors, which must be either certified public accountants or a public accounting firm, who are appointed at a general meeting of our unit holders, except for the first independent auditors that were appointed at our inception. Since our inception, KPMG AZSA LLC (AZSA) has been acting as our independent auditor.

Engagement Terms of Independent Auditors

AZSA conducts their audit in accordance with auditing standards generally accepted in Japan. AZSA is independent of NPR in accordance with the ethical requirements that are relevant to their audit of the financial statements in Japan, and AZSA fulfills their other ethical responsibilities in accordance with these requirements. AZSA audits the financial statements of NPR for every fiscal period and has been providing opinions since our inception which certifies fair representation, in all material respects, of the financial statement in accordance with accounting principles generally accepted in Japan. Also, AZSA has been providing opinions that they believe that the audit evidences we provide to AZSA is sufficient and appropriate for AZSA to provide a basis for their opinion.

Compensation for Independent Auditors

Our articles of incorporation, which is set forth by resolution at a general meeting of our unit holders, stipulates that the maximum amount of compensation to our independent auditors, for their audit services, is ¥20,000,000 per fiscal period. The Board is responsible for determining an actual amount of the compensation for our independent auditors. The subject compensation must be paid within three months after the receipt of audit reports and invoices from the independent auditors.

The historical amount of compensation paid to the independent auditors for their audit services and other non-audit services in each fiscal period is as follows:

| Nov. 2022 FP |

May 2023 FP |

Nov. 2023 FP |

May 2024 FP |

Nov. 2024 FP |

May 2025 FP |

|

|---|---|---|---|---|---|---|

| Compensation for Audit Services (Thousand yen) |

15,000 | 16,500 | 16,500 | 16,000 | 16,000 | 16,000 |

| Compensation for Non-Audit Services(Note) (Thousand yen) |

3,450 | 16,950 | 15,300 | - | 2,750 | - |

- We have provided compensation to AZSA for non-auditing services, including comfort letter preparation related to issuance of new investment units or investment corporation bonds, and not for any other non-audit services.

Management by the Board of Directors and Supervision by the Supervisory Directors

Our business is operated by the Board of Directors, which consists of one Executive Director and three Supervisory Directors. We currently hold a board meeting generally at least once a month. At board meetings, our Executive Director reports the status of operations of the Asset Manager and other matters pertaining to the operations of NPR. Each of our Supervisory Directors receives such reports from the Executive Director, and may request, if deemed necessary, reports pertaining to the status of the asset management operations from the Asset Manager. The Executive Director and the Supervisory Directors may request the officers and other personnel of the Asset Manager, the custodian and the general administrator to attend board meetings and provide explanations regarding the status of the Asset Manager’s operations.

Responsibilities of Supervisory Directors and Independent Auditors for NPR’s Financial Statements

Supervisory Directors and AZSA are responsible to appropriately supervise the status of performances of the Executive Director and NPR’s financial reporting process. AZSA is also responsible for providing reasonable assurance in connection with whether the financial statements of NPR as a whole are free from material misstatement, fraud or error, and for issuing an auditor’s report to the board that contains their independent opinions for every fiscal period of NPR.

SAME BOAT INVESTMENT BY THE PROLOGIS GROUP

Our sponsor, the Prologis Group, has been holding approximately 15% of our issued and outstanding units since the listing of our units on the Tokyo Stock Exchange in February 2013. Since our listing, the Prologis Group has consistently and publicly expressed its intent to hold our units for the long-term, maintaining the 15% ownership by purchasing an additional 15% of the units to be sold in the future follow-on offerings. Through this ownership, we believe that the interests of the Prologis Group and our unit holders are aligned and the Prologis Group’s investment in us will contribute to improvement of unit holder value by strengthening the support we receive from the Prologis Group.

- As of May 31, 2025

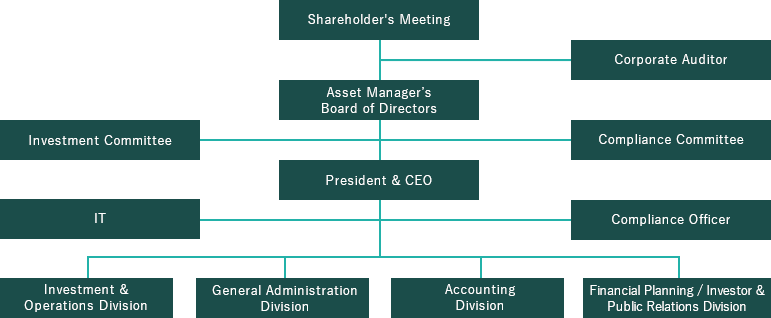

ORGANIZATIONAL AND GOVERNANCE STRUCTURE OF THE ASSET MANAGER

Prologis REIT Management K.K. (PLDRM) is acting as NPR’s Asset Manager based on the bilateral asset management agreement between NPR and PLDRM in accordance with the legal requirement under the ITA. The scope of PLDRM’s role is broad; examples are property acquisitions and disposition, operations/management of NPR’s portfolio, financing and investor relations, reporting to NPR’s board and other ancillary administrative work.

PLDRM is a wholly owned subsidiary of the Prologis Group and governed by its own board of directors and organizations described in the below chart. In addition, there are two committees which govern certain areas of PLDRM’s corporate actions in connection with its asset management functions. The Investment Committee is responsible for discussing and approving PLDRM’s asset management plans as well as NPR’s various transactions such as investments, dispositions and capital raising. The Compliance Committee is responsible for discussing and approving various compliance matters related to PLDRM’s corporate actions in certain areas, such as related-party transactions, and its governance. Each of the Investment Committee and the Compliance Committee is required to have at least one independent committee member who has veto rights to the proposed agenda.

Our Compliance Officer is Mr. Ryuji Murakami and he is responsible for legal compliance, compliance planning and promoting our compliance activities. The Compliance Officer reviews PLDRM’s administration from the viewpoint of compliance, and if there are some compliance issues that could occur, he has the authority to give necessary opinions or instructions to the officers and other personnel of PLDRM.

Please see the link below for the biographies of the directors.

VIEW BIOGRAPHIES OF PLDRM’S BOARD OF DIRECTORS, COMPLIANCE OFFICER AND INDEPENDENT COMMITTEE MEMBERS

Attendance at PLDRM's Committees

The following table summarizes the attendance of our Compliance Officer and independent committee members to the Investment Committee and the Compliance Committee:

Investment Committee

| CY 2020 | CY 2021 | CY 2022 | CY 2023 | CY 2024 | |

|---|---|---|---|---|---|

| Number of Meetings | 13 times | 12 times | 14 times | 13 times | 13 times |

| Attendance of Compliance Officer | 13 times out of 13 (100%) |

12 times out of 12 (100%) |

14 times out of 14 (100%) |

13 times out of 13 (100%) |

13 times out of 13 (100%) |

| Attendance of Independent Committee Member | 13 times out of 13 (100%) |

12 times out of 12 (100%) |

14 times out of 14 (100%) |

13 times out of 13 (100%) |

13 times out of 13 (100%) |

Compliance Committee

| CY 2020 | CY 2021 | CY 2022 | CY 2023 | CY 2024 | |

|---|---|---|---|---|---|

| Number of Meetings | 8 times | 6 times | 8 times | 7 times | 7 times |

| Attendance of Compliance Officer | 8 times out of 8 (100%) |

6 times out of 6 (100%) |

8 times out of 8 (100%) |

7 times out of 7 (100%) |

7 times out of 7 (100%) |

| Attendance of Independent Committee Member | 8 times out of 8 (100%) |

6 times out of 6 (100%) |

8 times out of 8 (100%) |

7 times out of 7 (100%) |

7 times out of 7 (100%) |

ESG

ESG